Here’s Why Investing in Singapore’s SRS is a Money-Saving Hack

For a lot of individuals, retirement planning is the furthest thing from our mind.

Yep, I already know what you’re thinking: BORINGGGGG. It’s so far into the future that it’s not exactly urgent on our to-do list.

And in Singapore, having to deal with the high cost of day-to-day living and rising inflation, it’s even further down the pecking order.

But that’s also exactly why we should try to use all the tools available to us to save money and invest at the same time.

With the Supplementary Retirement Scheme (SRS) in Singapore, individuals can save mad money in taxes while also investing. Here’s a quick run-down on how.

Contribute up to S$35,700 every year and offset that against tax

No one likes to pay taxes but we all have to. What the SRS lets you do is offset your contributions in the scheme against your taxable income.

If you’re a Singapore Citizen or Permanent Resident (PR), you can contribute up to S$15,300 per calendar year.

Even better, as a Foreigner in Singapore you can contribute up to S$35,700 per calendar year and have that offset your taxable income.

However, it only makes sense for you to contribute to the SRS once you reach a certain annual income level (S$40,000 or above).

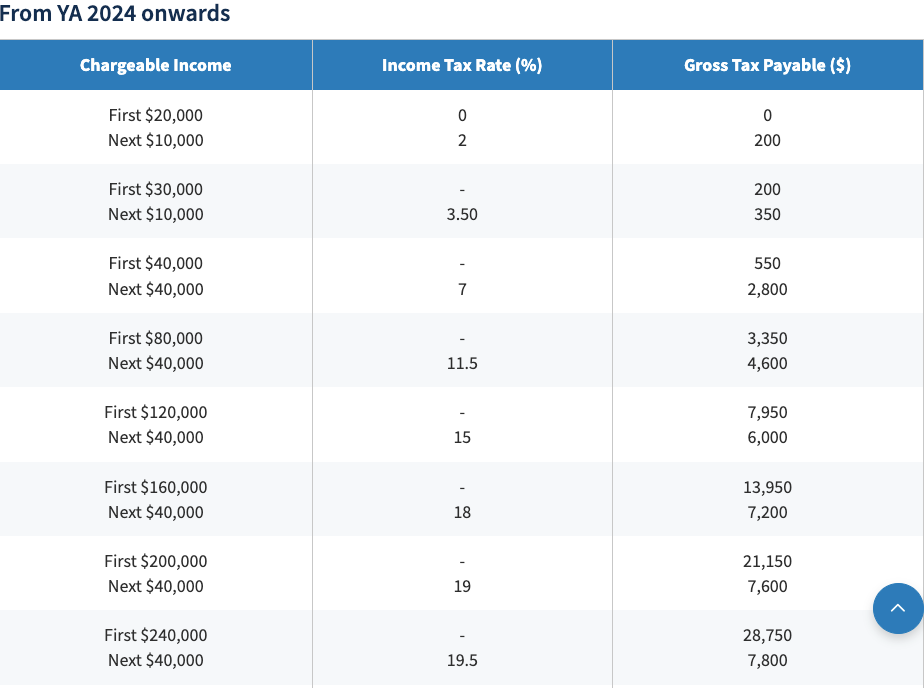

As you can see above, the income tax you’re liable to pay really starts to climb meaningfully after the first S$40,000.

That’s because you get taxed 7% on the next 40Gs you bring in.

How much can I save from the SRS?

Alright, so let’s get down to the key question. How much, in taxes, can you save from it?

Well, say you earn S$130,000 annually. And if you then contribute $$10,000 to the SRS, you’d be effectively saving 15% of S$10,000 which means S$1,500 off your tax bill for that year.

Meanwhile, if you’re a Foreigner earning S$280,000 per year and you want to max out the whole S$35,700 contribution cap in the SRS you could also save a tidy sum.

That would be 19.5% of S$35,700 (for that tax bracket), meaning you would save S$6,960 in taxes.

It’s actually a great way of forced retirement saving. That’s because you can’t touch it – if you’re a citizen or PR – until the mandatory retirement age of 63.

But if you’re a Foreigner – without any CPF contributions in Singapore – this could actually be even more important.

The rules for Foreigners are also more flexible in that you can withdraw the whole sum in there 10 years after your first contribution (without a penalty).

But what can you invest in with SRS?

First and foremost, making sure you DO NOT leave your SRS funds in cash is the key.

That’s because cash in an SRS account yields 0.05% per annum. Seriously. So, it’s basically like throwing cash in there for it to be burned by inflation.

You might be surprised to know that as recently as June 2021, according to the Business Times, over a quarter of all Supplementary Retirement Scheme funds were still sitting idle in cash.

And that was when there was a global bull market in stocks, inflation was low and interest rates were basically at 0%.

With inflation in Singapore now running at 5.5% and interest rates in the US closer to 5%, not investing is really not an option. You have to invest it.

Alright, so what are your options? That’s actually up to your SRS provider (you can only pick from the three big Singapore banks – DBS, UOB, or OCBC) but the trio typically offer these options:

- Singapore-listed stocks

- Singapore government securities (SGS) and Singapore Savings Bonds (SSBs)

- Single premium insurance

- Fixed deposits

- Foreign currency fixed deposits

- Unit trusts

The key exclusion to note is foreign-listed stocks, so basically you cannot hold any individual stocks listed outside of Singapore in your SRS account.

Understanding your retirement needs

For Singapore Citizens and PRs, the SRS may be a great way to save extra funds for retirement.

However, directing funds to it might be a secondary consideration after your CPF or CPF Investment Scheme (CPFIS) programmes.

Still, it can help to bring down your tax bill at the end of the year while helping you put your money to work over the long term.

For Foreigners, the SRS can act as a de facto pension in lieu of something like a CPF.

Given the penalties imposed on Singaporeans, PRs, and Foreigners for early withdrawal of funds, the SRS is a great way to both save tax and invest for retirement.

What’s there not to like about that?