ESG ETFs: Why You Should NOT Buy Them

You know how things marketed to women (like razors) are always more expensive than the men’s version but they’re effectively the same thing?

That’s what an ESG ETF reminds me of. I’ve never really understood ESG investing from an ETF perspective.

Environmental, Social, and Governance (ESG) investing is being sold as a hot trend. Of course, ETFs give you one way to play it.

But you’re overcharged for something that’s really not that dissimilar from what you’d buy anyway. Let me explain.

Take the iShares ESG Aware MSCI USA ETF (NYSE: ESGU). Its investment objective states that it aims to:

“Track the investment results of an index composed of U.S. companies that have positive environmental, social and governance characteristics”.

Alright, cool. But how does that actually differ from your plain old vanilla iShares Core S&P 500 ETF (NYSE: IVV) that tracks the S&P 500 Index?

Same, same but…actually the same

Well, it turns out it really doesn’t differ that much at all. If you take a look at the top 10 holdings of both the ESGU and IVV, nine of them are exactly the same.

Both lean heavily towards technology, with the top 10 stocks in the ESGU making up just over 25% of the ETF while (ok, fine) in the IVV it’s just slightly higher at 27%.

Yes but surely the performance of the ESGU is better than IVV, right?

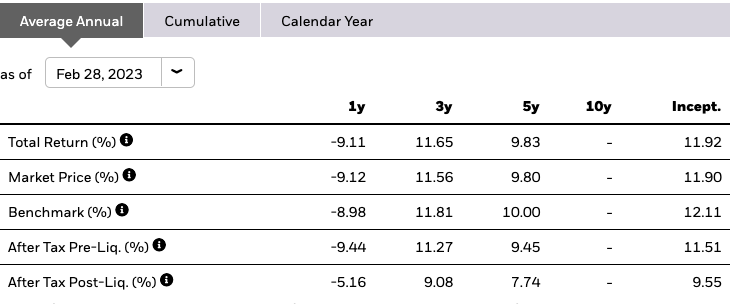

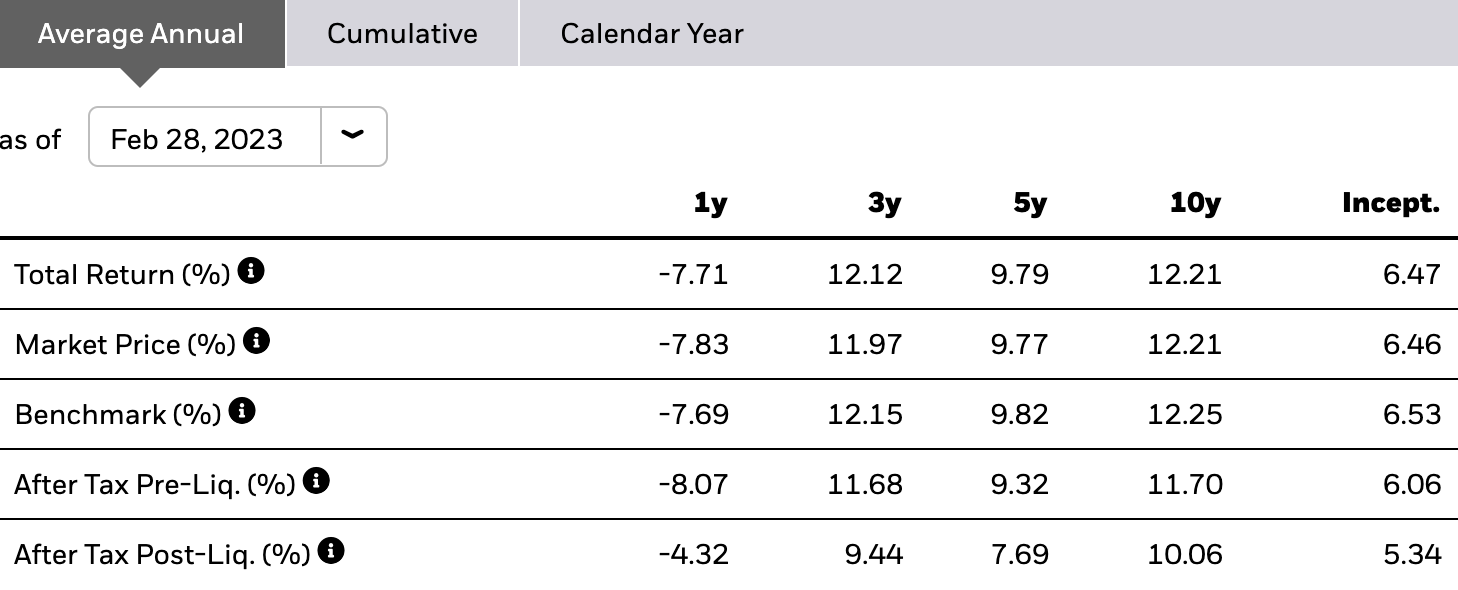

Actually, no. If you compare their annualised returns over the past 1, 3 and 5 years, the IVV is better.

What’s more, the ESGU essentially mirrors the core S&P 500 ETF. Just take a look at the below. Don’t they appear to be EXACTLY the same?

What’s more, the ESG ETF’s “beta” – which shows how closely it tracks the market – is 1.02.

A score of 1.0 means it’s perfectly correlated to the market, so a 1.02 beta isn’t giving you much of a difference versus just buying the overall S&P 500 Index.

You pay for the privilege of owning an ESG ETF!

So, we’ve established that performance is pretty much the same. So, what about cost?

That’s where the kicker comes in. The iShares ESG Aware ETF is FIVE times the cost of its iShares Core S&P 500 ETF.

Yes, you read that right first time. The ESGU charges investors an expense ratio of 0.15% per annum. That compares to the IVV expense ratio of 0.03%.

So, for every $1,000 that you hold in ESGU shares, iShares will take $1.50 from you – versus the $0.30 you’d be charged per $1,000 of IVV.

ESG investing is personal

At the end of the day, if you want to invest with an ethical lens on then you should be buying individual companies that align with your own values.

That’s because ESG investing is, I feel, a highly personal issue where people want more control over what they own.

Some investors will be fine holding arms manufacturers while others will not.

The same goes for casinos, alcohol, and a host of other companies. Hence, it doesn’t make much sense to invest in an ETF where you’re not able to oversee what you’re buying.

Fine, ESG ETFs exclude companies involved in tobacco, civilian firearms, and oil sands companies but there are plenty of other companies in ESG ETFs that may not align with your own personal values.

By charging a substantial amount more and basically mirroring the stock market index, ESG ETFs have a long way to go to prove themselves.